Why I wrote about applying “Love and Compassion” to our national Politics

I believe that everyone has a story to tell, whether it’s nonfiction or fiction. All of us have had unique experiences, which have shaped who we are today. So you may wonder … why did I write my recent book, Love and Compassion…Spiritual Solutions for our Politics and our Lives!

Well… I wanted to explore the real facts on the current topics of national debate. Often, we hear commentators or speakers talking about an issue such as universal health care or climate change. People with opposing views use different “facts” to support their position. So I asked myself: who is correct and what are their sources?

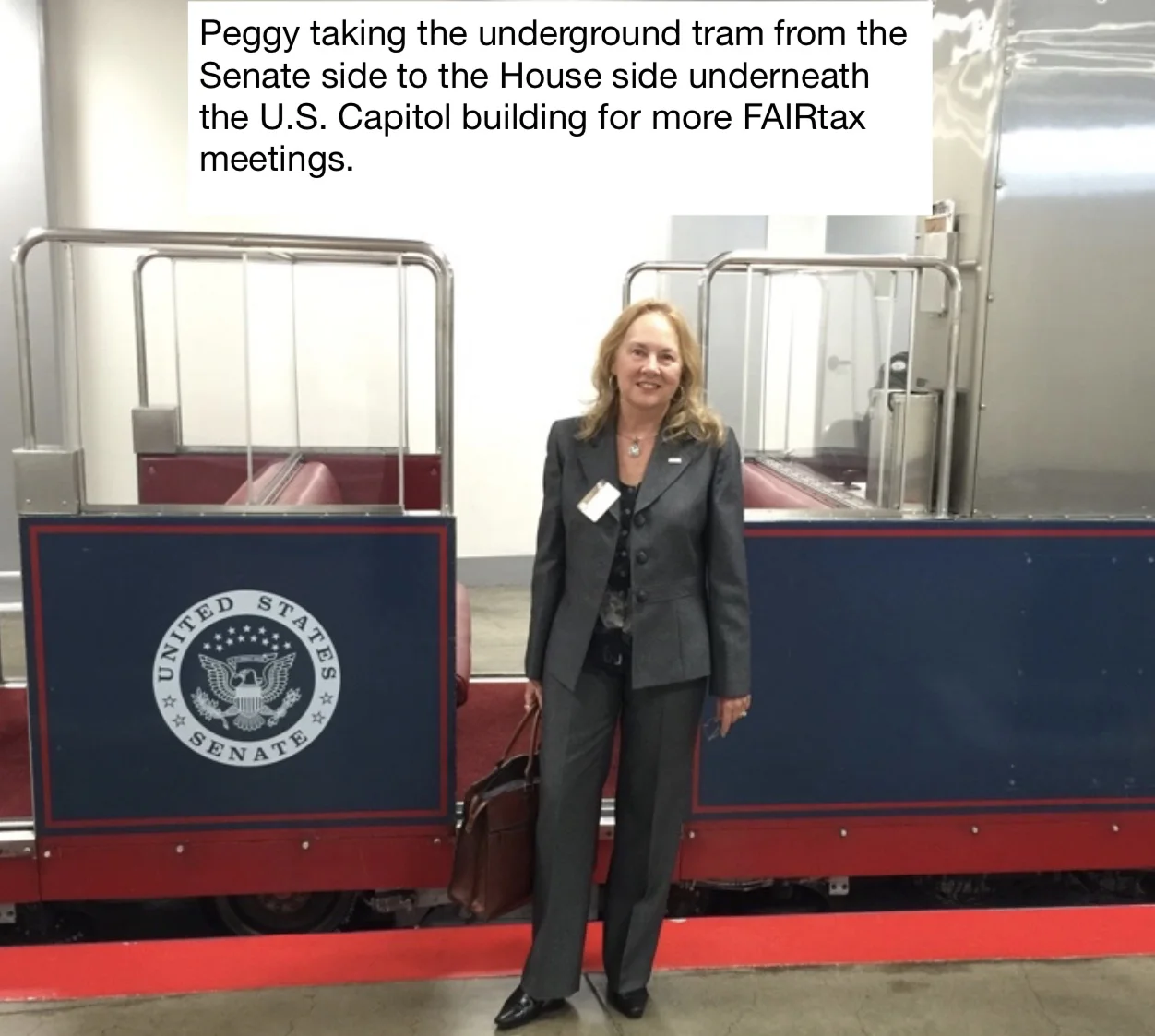

That was one part of the equation. Another reason to write this book was that I believe we need to replace the outdated, overly complex and highly manipulated income tax system. I volunteered for over two years with Americans For Fair Taxation to replace the current income tax system with a national sales tax, and met with many members of Congress. We have not yet achieved our goal. However, I believe that We the People can reach a bipartisan compromise for the 21st Century, and I am ready to continue that journey in order to reach a compassionate solution to finance our government programs and to provide financial security for all Americans.

And most important, I hoped to remind people that many of us share the same values that Jesus Christ taught us, namely love and compassion. I was concerned about the hateful comments that people were making to each other — people who otherwise say that Jesus’ message is part of their daily lives. Hopefully, supplying Americans with the facts will lead to more civil discussions about which direction the United States should take.

But you may ask, where did I find my facts? Today, because of the Internet, it’s much easier to research and write a book than ever before. You have access to information and articles online through government websites as well as respected media and nonprofit websites. You can actually see primary source documents, and compare those to what other writers are saying about a particular topic. I tried to explain the facts in a way that the average person could understand them. My book wasn’t written for academics or experts.

When I started this book, I did not realize that it would take me over two years to write and publish. Yes, even though I am “retired”, there are still milestone family birthdays, anniversaries, vacations, etc., which fill my blessed life. And then there is the learning curve of the publishing process, which will be the topic of one of my future blogs.

I hope that you enjoy reading my book, and learning the facts, which I separated from my Commentary appearing at the end of most chapters. If we can agree on the facts, then we may be closer to agreeing on the solutions or at least forging a compromise.

If we achieve that goal, then my time will have been well spent in providing a return to Jesus’ message of love and compassion in our everyday lives!

Peggy

TESTIMONY for a NATIONAL SALES TAX by Peggy Green-Ernst on April 9, 2015 Presented to the State of Texas “Select Committee for State & Federal Power and Responsibility” (The Fair Tax resolution was unanimously passed later by the committee on a bipartisan basis!):

Good afternoon! I am Peggy Green-Ernst, Director of Government Relations for Americans For Fair Taxation, and a native Texan. I am here today to testify in support of HCR 27. Thank you Representative Stephenson for introducing this Resolution to encourage members of Congress and the President to replace the current federal income tax and payroll tax with a simple, fair and transparent national retail sales tax on NEW goods and services, and to repeal the 16th Amendment of the U.S. Constitution, which allows the federal income tax. I have been following tax reform since the 1980s, when I was Director of Government Relations for National Gypsum Company, a building material manufacturer. As I saw more and more jobs going offshore, I became concerned for American workers, who were losing their jobs. Over the past 30 years, I looked for something that could change the course of that direction. I came to the conclusion that the current income tax system not only makes our products less competitive, but that the system is unfair and too complex for anyone to understand the over 74,000 pages of tax code and regulations. I wanted a solution that unites us and doesn’t pick winners and losers. Our only recourse is to get rid of the current tax system, and fund our government with an indirect sales tax, like we have here in Texas.

However, this national retail sales tax goes one step further. It gets rid of the highly regressive payroll tax, which hurts the middle and lower income workers.

With the national sales tax, there is no more personal, corporate, estate, gift, or payroll taxes. Just imagine — no more laboring over income tax returns! The U.S. becomes the corporate tax haven of the world, and a magnet for jobs! Our products would be more competitive internationally since they would no longer be front-loaded with income and payroll taxes.

The sales tax also addresses the growing tax evasion issue, which is starting to get the attention of members of Congress. Tax evasion has doubled over the last five years with current projections of $500 billion to $800 billion, and is projected to double over the next five years. That is unsustainable! It’s also unfair to the many workers who receive W2s or 1099s, since 99% of their wages are reported. Those are our teachers, our firefighters, office workers and hourly employees. There is a drop off in fully reporting income by those who are self-employed, and more significantly by those who receive cash only for their services.

On the other hand, the national retail sales tax is revenue neutral, raising the same amount of money as the current system. Since 90% of business transactions are done with 10% of the big box stores, like Walmart, there is significantly less tax evasion with the sales tax. In addition, this stable revenue stream will now be funded by over 40 million annual foreign tourists as well as the underground cash economy. There will be sustainable funding for Social Security and Medicare!

In order to alleviate any hardship from an increased sales tax, a monthly prebate is paid to all legal residents, which covers sales tax on basic necessities up to the poverty level. And if one chooses to buy mostly used goods, there is no sales tax!

How will the Fair Tax Act benefit Americans? First and foremost, it will be simple, fair and transparent. Trillions of dollars of offshore wealth will return to our country, and more jobs are created. Plus, the IRS will be dismantled and defunded.

The FairTax Act is gaining momentum in Washington, DC. We have more cosponsors at the beginning of a legislative session than ever before — 68 members of the House, and 6 members of the Senate. Over $20 million was spent on research — more than any other proposed tax reform alternative.

So why do we need a FairTax Resolution passed by this Committee and then by the Texas legislature? Florida passed this Resolution last year, and I am now leading this effort throughout the United States. We need to show Congress that We the People want this change, and I believe state legislators are closer to their constituents and can see how this could simplify their lives. In order to repeal the 16th Amendment to the U.S. Constitution, the states will have to ratify that legislation. By showing Congress that we support this nonbinding Resolution, they will know that ratification can be swift.

I am hopeful that this Resolution will give Congress the courage to pass transformative and historic tax reform. With your help, we can do this for the American people and for our children and our grandchildren! I hope that you will support this Resolution. Thank you for this opportunity for me to share my comments with you today!

Remembering our Veterans on Memorial Day

As I reflect on this Memorial Day, I am posting the following from Chapter 6 on Military Defense from my book, Love and Compassion…Spiritual Solutions for our Politics and our Lives!

(page 128) “U.S. Military Service during Wartime (1775-1991): In honor of the brave men and women in the U.S. military, let’s remember the sacrifices that they have endured for our country! According to the U.S. Department of Veterans Affairs (September 2010), there have been 41,892,128 U.S. military serving during wartime from 1775 through 1991. Of those, there were 651,031 battle deaths, 308,800 other deaths (in theater; meaning in or near the combat area), 230,254 other deaths (non-combat), and 1,430,290 non-mortal wounded. As of 1991, there were 16,962,000 living war veterans, and 23,234,000 living veterans who served in times of war and peace.”

(and pages 83-84 at the beginning of the chapter) “As I have mentioned earlier, I am from a military family. My father, husband, brother, uncles, and nephew served our country in different branches: Air Force; Marines; and Army. I grew up around the world in Europe, Asia, Central America and the north Pacific Ocean. My father served in the U.S. Air Force for over 21 years (1946-1967). My mother, brother, sister and I were fortunate to travel with him and to experience a global adventure. I still get emotional when I hear the military songs for each branch of the armed forces, and often when I say the pledge of allegiance to the American flag. I always knew that we would return to the United States, and that I was just a visitor in a foreign land. I felt secure with that knowledge, and I gained perspective and respect for other cultures.”

On this Memorial Day and throughout the year, we should always honor and support our veterans!!

Peggy

What to know about visiting your member of Congress on Capitol Hill

[This blog was written in 2019 before the pandemic, and security measures have changed since that time!]